The necessity of digital onboarding is underscored by the growing demand for instant and personalized banking services. As consumers increasingly prioritize convenience and speed, banks that fail to deliver efficient onboarding experiences risk losing out to competitors who do. Thus, investing in cutting-edge digital onboarding solutions is not just about enhancing customer satisfaction; it's about ensuring the bank's competitive viability in a market that's more crowded and challenging than ever. The average time spent on digital banking apps increased to 10.2 minutes per session in 2025, with increased engagement in digital features.

Digital onboarding eliminates the need for physical interactions by integrating new customers through digital platforms. This shift streamlines onboarding, saving time and resources for both banks and customers. It also allows banks to expand their reach beyond geographical boundaries, catering to diverse regions and demographics with culturally tailored approaches. Given that modern consumers are more willing to switch financial providers if their needs are unmet, digital onboarding is a critical driver for attracting and retaining customers.

Real-Life Example:

HDFC Bank in India launched its “Go Digital” campaign, leveraging its Digital Factory and mobile banking innovations to boost digital transactions to 63%—significantly accelerating onboarding and engagement. [IJFMR]

Enhancing the Banking Customer Journey

Banking customer journey is a multifaceted path that begins with the initial point of contact and continues through various stages of engagement and service. A frictionless onboarding process serves as a critical touchpoint that can significantly influence the customer's perception and future interactions with the bank. If the onboarding process is smooth, customers are more likely to trust the bank and feel confident in their choice, which can lead to higher satisfaction and retention rates.

By simplifying this journey through digital means, banks can reduce dropout rates, enhance customer satisfaction, and foster long-term loyalty. The integration of digital onboarding banking solutions allows for a more personalized approach, catering to individual needs and preferences while ensuring compliance with regulatory standards. This personalization can manifest in various forms, such as customized product recommendations or tailored communication channels, which can enhance the overall customer experience.

Real-Life Example:

U.S. Bank piloted “Onboarding Tracker” in partnership with Twain Financial, cutting commercial account opening time from 15 to 10 days, improving transparency and efficiency. [US Bank]

In addition, a seamless onboarding experience can serve as a differentiator in a competitive market. Customers today have a plethora of options at their disposal, and their loyalty is often contingent upon the quality of service they receive from the outset. Banks that excel in providing a frictionless onboarding experience are more likely to attract and retain customers, thereby solidifying their market position.

Virtual Onboarding Tools The Backbone of Modern Banking

The implementation of virtual onboarding tools has revolutionized the way banks interact with their customers. These tools leverage cutting-edge technology to create a seamless and engaging onboarding experience that caters to the demands of the digital age. By integrating advanced technologies such as artificial intelligence, machine learning, and biometrics, banks can offer a more secure and efficient onboarding process that meets the expectations of today's tech-savvy consumers.

Real-Life Example:

Mashreq Bank in the UAE deployed electronic facial recognition (EFR) to power fully paperless onboarding for corporate clients, dramatically reducing timetoaccount opening. [PYMNTS]

Virtual onboarding tools also enable banks to gather valuable customer data during the initial stages of interaction. This data can be used to gain insights into customer preferences and behaviors, allowing banks to tailor their services accordingly. By leveraging this information, banks can not only improve the onboarding process but also enhance the overall customer journey, leading to increased satisfaction and loyalty.

Key Features of Effective Onboarding Tools

1. User-Friendly Interfaces: Intuitive design and easy navigation are paramount. A complex interface can deter potential customers, leading to abandonment before the onboarding process is complete. Banks must prioritize user experience by ensuring that their digital platforms are accessible and straightforward, reducing friction and enhancing customer satisfaction.

2. Identity Verification: Secure and efficient identity verification processes, such as biometric authentication and AI-driven document verification, ensure compliance with Know Your Customer (KYC) regulations. These technologies not only enhance security but also streamline the onboarding process, making it faster and more convenient for customers.

3. Data Integration: Seamless data integration capabilities allow banks to gather, analyze, and utilize customer data effectively, enhancing the overall banking customer journey. By consolidating data from various sources, banks can create a comprehensive view of each customer, enabling them to provide more personalized and relevant services.

4.Personalization: Leveraging data analytics, banks can offer personalized recommendations and services, increasing the relevance and appeal of their offerings. Personalization can take many forms, from customized product suggestions to tailored communication strategies, all aimed at enhancing the customer experience and fostering loyalty.

Overcoming Challenges in Digital Onboarding

While the benefits of digital onboarding are substantial, the transition from traditional methods is not without its challenges. More than 63% of customers leave digital banking applications due to complicated onboarding. A shorter onboarding process can increase client retention by up to 50%Here, we explore some of the key obstacles and how banks can overcome them. The shift to digital onboarding requires a comprehensive strategy that addresses both technological and organizational barriers, ensuring a smooth transition that benefits both the bank and its customers.

- Cultural Shift: Training and change management are essential to help employees embrace new digital processes.

- Data Privacy and Security: Banks must implement advanced security measures and compliance to protect customer information, while maintaining transparency to build customer trust.

- Technological Integration: Integrating new scalable technologies with legacy systems requires careful planning and collaboration with technology partners to ensure smooth functionality.

The Impact of Frictionless Onboarding on Customer Growth

A well-executed digital onboarding strategy can serve as a catalyst for customer growth. By providing a positive initial experience, banks can increase conversion rates and establish a solid foundation for ongoing customer relationships. The initial impression a customer forms during the onboarding process can significantly influence their perception of the bank and their willingness to engage with its services.

Moreover, a seamless onboarding process can enhance customer engagement by creating a sense of trust and confidence. When customers feel valued and understood, they are more likely to explore additional services and deepen their relationship with the bank. This can lead to increased cross-selling opportunities and higher revenue generation for the bank.

Increased Engagement and Retention

A smooth onboarding process sets the tone for the entire customer journey, increasing engagement and reducing churn. Satisfied customers are more likely to explore additional services and recommend the bank to others, amplifying growth through organic referrals. The positive word-of-mouth generated by satisfied customers can be a powerful driver of growth, especially in an industry where trust and reputation are paramount.

Furthermore, by continuously engaging with customers and seeking feedback, banks can identify areas for improvement and enhance the overall customer experience. This proactive approach to customer engagement can lead to higher retention rates and foster long-term loyalty, contributing to sustained growth and success.

Competitive Advantage

In a saturated market, the ability to offer superior onboarding experience can differentiate a bank from its competitors. Those who excel in digital onboarding are better positioned to attract and retain tech-savvy customers who prioritize convenience and efficiency. By offering seamless and personalized onboarding experience, banks can set themselves apart and create a strong competitive advantage.

Additionally, a focus on digital onboarding can enhance a bank's brand image and reputation. Customers are more likely to trust and choose banks that are perceived as innovative and forward-thinking, further solidifying the bank's position in the market. By continuously investing in digital onboarding solutions, banks can maintain their competitive edge and drive sustained growth.

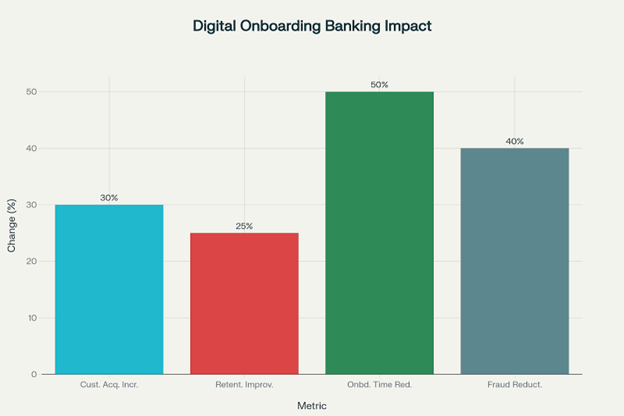

Impact of Digital Onboarding on Banking Metrics (2023-2025 Industry Reports)

Future Trends in Digital Onboarding

Looking ahead, several trends will shape digital onboarding in banking:

- Customer-Centricity: Increasing emphasis on personalized experiences aligned with consumer preferences.

- Artificial Intelligence and Machine Learning: Enhanced personalization, automation of routine tasks, and improved decision-making for faster, more efficient onboarding.

- Blockchain Technology: Offering increased security and transparency through decentralized, tamper-proof ledgers that simplify identity verification and reduce fraud risk. Blockchain also facilitates seamless data sharing across platforms, fostering industry collaboration.

Final Thoughts

In conclusion, digital onboarding in banking is a pivotal component of the modern customer acquisition strategy. By prioritizing a frictionless start, banks can not only meet but exceed customer expectations, driving growth and securing a competitive advantage in the digital era. The importance of a seamless onboarding experience cannot be overstated, as it sets the foundation for a positive and lasting customer relationship.

As we continue to navigate the complexities of the digital landscape, embracing innovative solutions and technologies will be crucial for sustained success and customer satisfaction. Banks that are able to adapt and evolve in response to changing consumer demands will be well-positioned to thrive in the future. By investing in digital onboarding solutions, banks can create a more inclusive and engaging customer experience, driving growth and success in the digital age.

Why Axeno?

With extensive experience in building compliant, secure, and highly intuitive onboarding journeys, Axeno Consulting empowers banks to accelerate customer acquisition. From streamlining KYC/AML processes to integrating AI-powered personalization, Axeno’s tailored digital solutions ensure financial institutions can deliver best-in-class onboarding experiences that foster trust, efficiency, and long-term engagement.

Ready to elevate your bank’s onboarding experience? Connect with Axeno today and discover how our digital solutions can fast-track your customer growth.

-1.png)