- Home /

- Insurance Industry /

Make Insurance Seamless with Personalized Digital Journeys

For insurance providers across India, the Middle East, and the US, one thing is clear: policyholders don’t want paperwork and headaches – they want clarity, simplicity, and proactive communication.

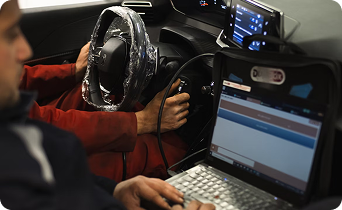

Customer experience in insurance must guide people through getting a quote, buying a policy, filing claims, and renewing coverage with empathy and efficiency. A seamless digital journey in insurance, from the first interaction to the resolution of a claim, builds trust at every touchpoint. When done right, it improves speed (e.g. faster policy issuance and claim settlements), increases transparency (customers feel in control and informed), and boosts satisfaction throughout the customer lifecycle. In an era of rising InsurTech competition, delivering a convenient, customer-first digital experience is essential for traditional insurers to retain customers and grow their business.

of insurance executives say CX is a top strategic priority, yet nearly 49% of customers have left due to poor digital experience.

of insurance customers will switch providers if communication expectations aren't met.

What we deliver

Personalized quote-to-claim journeys

Automated digital onboarding

AI-powered customer service

Lifecycle engagement & retention

Secure self-service portals

Why Axeno

Axeno has delivered complete customer journey solutions for major life and health insurers. We understand the nuances of each stage – from simplifying a life insurance quote flow to automating health insurance claims – and we apply this domain knowledge to craft experiences that truly work for insurance customers and internal teams.

Real-time journey orchestration

Proven impact on key metrics

Compliance and accessibility built-in

CX with empathy and efficiency

Clients

-2.png?width=55&height=55&name=Vector%20(5)-2.png)

-1.png)