In the insurance industry, customer engagement is paramount. It's the key to retaining policyholders and attracting new ones. But how can insurance companies ensure consistent, personalized engagement across multiple channels? The answer lies in an effective omnichannel strategy for insurance. An omnichannel approach allows insurers to interact with customers seamlessly, whether online or offline. It's about providing a unified, cohesive experience across all touchpoints. However, implementing such a strategy can be challenging. It requires the right technology, data integration, and a deep understanding of customer behavior. This is where Adobe Journey Optimizer (AJO) comes into play. AJO is a powerful tool that can help insurers create and manage personalized customer journeys. In this article, we'll explore how to redefine your omnichannel strategy with AJO, driving policyholder engagement and enhancing the overall customer experience.

The Importance of Omnichannel Strategy in the Insurance Industry

The insurance industry is experiencing a digital transformation. Customers now expect seamless interactions across various channels. This shift underscores the need for an omnichannel strategy. An effective omnichannel approach improves customer engagement. It allows insurers to provide a consistent, personalized experience. This consistency is crucial for building trust and loyalty among policyholders. With an omnichannel strategy, insurance companies can stay competitive. They can meet rising customer expectations by offering tailored interactions. Satisfying these expectations can significantly impact customer retention rates. Moreover, an omnichannel strategy helps streamline operations. By integrating different communication channels, insurers can reduce operational silos. This integration enhances efficiency and responsiveness to customer inquiries. In today’s fast-paced market, having a robust omnichannel strategy is not optional. It is essential for insurers aiming to thrive. Those who embrace this approach can improve customer experiences, boost engagement, and drive business success.

Understanding Adobe Journey Optimizer (AJO) and Its Role in Customer Engagement

Adobe Journey Optimizer (AJO) is a powerful tool for modern insurers. It plays a vital role in enhancing customer interactions. AJO empowers insurers to deliver personalized experiences at scale. One key feature of AJO is its capacity for real-time decision-making. This allows insurers to adjust their strategies instantly. Such agility is crucial in the dynamic insurance landscape. AJO seamlessly integrates data from multiple sources. This integration creates a unified view of the customer. Insurers can leverage this comprehensive data to tailor interactions, making them more relevant and effective. With AJO, customer journeys become more predictable and optimized. Through data-driven insights, insurers can anticipate policyholder needs. This predictive capacity enhances customer satisfaction and loyalty. Furthermore, AJO facilitates better customer segmentation. By targeting specific groups, insurers can deliver relevant content and offers. This targeted approach helps increase engagement and improve conversion rates.

Key Features of Adobe Journey Optimizer for Insurance Companies

Adobe Journey Optimizer offers several features beneficial to insurers. These features streamline operations and enhance customer experience.

- Real-time personalization: Tailors interactions based on current customer data.

- Cross-channel orchestration: Ensures consistent messaging across all touchpoints.

- Automated journeys: Simplifies complex processes, reducing manual input.

- AI-driven insights: Provides actionable data to refine strategies continuously.

These features help insurers craft personalized and efficient journeys. By leveraging these tools, companies can create meaningful interactions. In turn, this leads to more satisfied and loyal policyholders.

Overcoming Challenges with AJO in Your Omnichannel Strategy

Implementing an omnichannel strategy in the insurance sector has its challenges. These include data silos, outdated systems, and resource limitations. Adobe Journey Optimizer (AJO) can help tackle these issues effectively. AJO provides a streamlined approach by integrating disparate data sources. This creates a seamless customer experience. It unifies data, ensuring consistent and relevant communication across all channels. Another challenge is aligning various departments within an organization. AJO supports collaborative workflows, enabling teams to work cohesively. This fosters a more integrated approach to customer engagement. Finally, resources and time can often limit omnichannel strategies. AJO helps automate and optimize processes. This reduces workload and allows more strategic initiatives, focusing efforts on customer engagement rather than operational burdens.

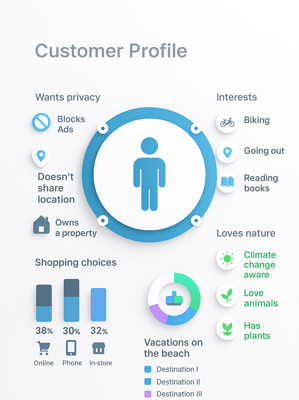

Integrating Customer Data Platforms (CDP) for Personalization

Customer Data Platforms (CDP) are crucial for personalization in insurance. They gather and unify customer data from numerous channels. This integration creates a comprehensive customer profile. Adobe Journey Optimizer leverages CDPs to enhance customer interactions. It utilizes this data to deliver personalized experiences. These tailored communications address customer needs more effectively. A CDP's strength lies in its real-time data analysis. This capability enables insurers to respond promptly to customer actions. Rapid responses drive more meaningful engagement and satisfaction. Overall, integrating a CDP into your omnichannel strategy with AJO ensures personalized and proactive customer interaction. By harnessing data insights, insurers can deliver value-driven experiences. This level of personalization strengthens customer relationships and promotes brand loyalty.

Case Studies: Success Stories of Omnichannel Implementation in Insurance

Insurance companies worldwide are reaping the benefits of omnichannel strategies. One standout example is a major global insurer that revamped its customer engagement approach using Adobe Journey Optimizer. This insurer integrated its digital and physical touchpoints with AJO, creating a unified customer experience. The result was a seamless journey across channels, leading to improved customer satisfaction and increased policy renewals. Another success story involves a regional insurer who faced high churn rates. They adopted AJO to better understand and engage with their customer base. By leveraging AI-driven insights, they personalized communications, dramatically reducing customer churn. A third noteworthy case highlights an insurer who focused on real-time interaction. They harnessed AJO's capabilities to provide timely and relevant responses to customer inquiries and claims, enhancing trust and loyalty. These cases exemplify how AJO can transform insurance companies, driving operational efficiency and enriching customer experiences through a refined omnichannel strategy.

Strategies for Enhancing Customer Experience Across Multiple Channels

To thrive in today's competitive landscape, insurers must elevate customer experiences across all channels. Consistent and personalized interactions are key to satisfying modern policyholders. By implementing a robust omnichannel strategy, insurers can achieve a cohesive brand presence.

Key strategies include:

- Using data analytics to predict customer preferences and tailor interactions.

- Ensuring seamless transitions between online and offline channels.

- Employing consistent messaging across all customer touchpoints.

These strategies help insurers meet the evolving expectations of their customers. A significant aspect of successful omnichannel implementation is the integration of technology, which allows for streamlined communication. This ensures that policyholders receive timely and relevant information. Additionally, insurers should focus on feedback loops, gathering insights from customer interactions to refine strategies. By acting on customer feedback, insurers can continuously improve service quality, fostering deeper engagement and loyalty.

Leveraging AI and Machine Learning for Customer Journey Optimization

AI and machine learning are transforming customer journeys in the insurance sector. By harnessing these technologies, insurers can anticipate and meet customer needs more effectively. Predictive analytics allow insurers to foresee trends and prepare personalized offerings. Machine learning enables dynamic customer segmentation, ensuring tailored engagements. By leveraging customer data, insurers can identify patterns and refine marketing strategies. This results in more relevant communications that resonate with policyholders. AI-driven automation simplifies complex processes, increasing operational efficiency. For example, chatbots can provide instant support, freeing up human resources for complex inquiries. This enhances the overall customer experience and reduces response times. AI and machine learning offer actionable insights that empower insurers to adjust strategies in real-time. By embracing these technologies, insurance companies can optimize customer journeys, enhance satisfaction, and increase customer retention. The integration of AI is not just a trend, but a necessity for future success.

Best Practices for Implementing an Omnichannel Strategy with AJO

Implementing an omnichannel strategy requires precision and a thoughtful approach. Adobe Journey Optimizer (AJO) provides tools that streamline this process for insurers. Utilizing AJO ensures more cohesive customer interactions across platforms.

To effectively implement AJO, consider the following best practices:

- Align business goals with customer needs: Ensure objectives support customer satisfaction and engagement.

- Utilize data effectively: Leverage AJO's analytics for insights into customer behavior.

- Prioritize consistent messaging: Maintain brand voice across all channels.

- Foster cross-department collaboration: Encourage teams like marketing and IT to work together.

These practices are essential in creating a seamless customer experience. Furthermore, continuous improvement is vital. Regularly assess your strategy to identify areas for enhancement. This ensures that the strategy remains effective and aligned with changing customer expectations. Lastly, provide training and support for staff. Equipping employees with the necessary skills and knowledge facilitates successful adoption of new technologies. This empowers teams to maximize the benefits of AJO and deliver an exceptional omnichannel experience.

Measuring and Analyzing Customer Engagement to Refine Omnichannel Efforts

Measuring customer engagement is crucial for refining omnichannel strategies. By evaluating engagement metrics, insurers can understand their strategy's effectiveness. This involves tracking interactions across all platforms to gather actionable insights. Data analysis plays a key role in this process. By examining patterns and trends, insurers can identify successful tactics. This enables them to refine their approach and enhance customer experience over time. It's important to use a comprehensive array of engagement metrics, including customer satisfaction scores, retention rates, and interaction frequency. Feedback is equally important. Encouraging customers to voice their thoughts can uncover areas for improvement. Insurers should actively seek and incorporate feedback into strategy adjustments. This fosters a customer-centric approach that prioritizes policyholder needs. By consistently measuring and analyzing engagement, insurers can make data-driven decisions. This not only improves the customer journey but also aligns the omnichannel strategy with business goals. In today's fast-paced insurance landscape, such agility is indispensable.

The Future of Omnichannel Strategies in Insurance: Trends and Predictions

The future of omnichannel strategies in insurance promises exciting developments. As technology evolves, insurers must adapt to meet increasing customer demands. One emerging trend is the integration of AI and machine learning into customer interactions. These technologies allow for smarter, more personalized engagements. Another key trend is the increasing use of predictive analytics. Insurers can anticipate customer needs and preferences, providing proactive solutions. This forward-thinking approach can significantly enhance customer satisfaction. It also helps insurers stay ahead in a competitive market. Mobile optimization will continue to grow in importance. As more customers engage through mobile devices, seamless mobile experiences will be essential. This includes responsive design and easy navigation, critical to customer retention. Optimized mobile platforms ensure convenience and satisfaction. Finally, there is a strong emphasis on data security. As customer data becomes more integral to strategies, protecting it is crucial. Implementing strong data governance frameworks will be vital for gaining and maintaining customer trust. This reinforces the insurer's reputation, ensuring long-term success.

Conclusion: Embracing Omnichannel with Adobe Journey Optimizer for Insurance Success

In the fast-changing insurance industry, adopting an omnichannel strategy is crucial. Adobe Journey Optimizer offers powerful tools for enhancing customer engagement. By integrating AJO, insurers can craft seamless and personalized experiences. Leveraging AJO allows insurance companies to better understand their customers. This leads to more effective interactions across all channels. Insurers can anticipate needs and respond proactively, fostering loyalty and satisfaction. Ultimately, success hinges on being customer-centric and data-driven. Embracing AJO in your omnichannel strategy positions your company for future growth. It's about creating meaningful connections that resonate with today's policyholders.

Ready to elevate your policyholder engagement? [Contact us to explore what’s possible.]

-1.png)